Van insurance contact us

Manage and make changes to your van insurance policy online

It’s easier than ever to manage your policy online through your AXA account. Here are just a few of the things you can do.

- View, download, and print your documents at your convenience

- Add products your policy or start a new quote for other AXA products

- Make changes to your policy details, including your cover level and details

- Update your contact details or marketing preferences

- View your renewals

Quick fixes

Did you know that many of changes you want to make can be done online? It’s quick, easy, and you can do it from wherever you are. Below we’ve are some of the most common questions and changes our customers are looking for – take a look and see if we can help you get things sorted.

No Claims Discount

Got a questions about your No Claims Discount (NCD)? Here are some common FAQs that might help.

Have you received my NCD proof?

Thanks for sending in proof of your no claims discount. When you send sent it in, you should have received an email from us to let you know that we’ve received it.

If you haven’t got your confirmation email, please resend your proof to us at van.insurance@axa-insurance.co.uk.

At this point, if we haven’t received what we need, or we have any questions about what you’ve sent us, we’ll get in touch with you as soon as we can.

In order to process your query, we need you to include a few key details in your initial email to us. These are as follows: your policy number, full name, date of birth (D.O.B), the first line of your address and your postcode.

Where can I get proof of my NCD?

If you need us to provide you with proof of your no claims discount, we can only do this once your policy has ended. So, please ensure you’re only contacting us once this is the case. When it has, we’ll arrange for proof to be sent out to you.

If you’re a new AXA customer and we’ve asked you for proof of your NCD entitlement, you’ll have to contact your previous insurer to get this as we can’t do that for you.

It’s important that you send us your proof of NCD within 28 days of starting your policy with us. If you don’t, there’s a possibility that your policy could be cancelled or become a more expensive as a result.

Please note: If your policy has been cancelled or has expired your No Claims Discount will be sent to you automatically.

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

I’m unable to provide proof of a NCD

If you’re receiving emails from us asking you to send in proof of your NCD for your new policy, but you’re unable to get hold of this for any reason, please get in touch to discuss how we can help you.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Where do I send my NCD?

After purchasing your van insurance policy with us, you’ll need to send us proof of your no claims discount within 28 days of buying your policy.

Please send an NCD proof document or a renewal invitation document provided by your previous insurer – it will need to show your full name, policy expiration date and your no claims discount entitlement on it.

Please send NCD proof and your policy number via email or by post to:

Email: van.insurance@axa-insurance.co.uk

Address: AXA Insurance UK plc, PO BOX 27025, Glasgow G2 9FQ

In order to process your query, we need you to include a few key details in your initial email to us. These are as follows: your policy number, full name, date of birth (D.O.B), the first line of your address and your postcode.

What happens if I don’t send you proof of my NCD?

If we don’t receive proof within 28 days of your policy start date, we won’t be able to approve your discount and we’ll be in touch to let you know what the next steps are.

What if I’ve already sent proof of a NCD?

If you’ve received an email requesting proof of your NCD but you’ve recently sent it to us, please ignore this email as we may still be processing your documents. Once this has happened you should receive a confirmation email. If you don’t receive a confirmation email over the next few days, please resend your proof using the contact details above or get in touch via Live Chat or by phone.

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Can I use my NCD on more than one vehicle?

No. Your no claims discount can only be used on one policy at a time, so if it’s already being used on another vehicle, you can't transfer it to another.

Frequently asked questions about NCDs

No Claims Discounts can be a tricky subject to wrap your head around, and it's natural to have questions. If you still need a little extra help, check out our Frequently Asked Questions about No Claims Discounts below.

Mirrored No Claims Discount

Understanding a Mirrored No Claims Discount can be tricky. We've pulled together some of the most commonl asked questions about mirrored NCDs below to help you get the asnwers you need.

What is a mirrored NCD?

A mirrored no claims discount can 'reflect' your current no claims discount, applying it to a second vehicle that you've just bought.

This means that if you’re unable to transfer an NCD to your new policy with us then we may be able to offer you a discount on your premium to recognise your claims free driving history.

This might happen if, for example, your NCD is already being used on another car or van you own.

If this happens, we’ll ask you for details about the no claims discount you are earning on your other policy. If these details are acceptable to us, the discount we offer you is called a mirror no claims discount.

Please note: this can only be done if you/your named drivers haven't had any claims where you've been at fault, or any motoring convictions.

I need help with a mirror bonus

A mirrored no claims discount is when we apply a discount to your new policy that recognises a NCD which you’re currently earning on another car or van policy in your name.

When you send us proof of your no claims discount, you’ll receive an email letting you know we have received your document and that we’ll be in touch shortly.

We would require evidence of this in the form of an active policy schedule from your current insurer.

Send this document to van.insurance@axa-insurance.co.uk.

There are eligibility rules for this though, so please get in touch to find out whether you qualify.

In order to process your query, we need you to include a few key details in your initial email to us. These are as follows: your policy number, full name, date of birth (D.O.B), the first line of your address and your postcode.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Do I qualify for a mirrored No Claims Discount?

You may be able to qualify for a mirror no claims discount if:

- The van you want to insure with us has not been insured by you previously

- You are currently earning a no claims discount on another car or van that you own

- The policy you wish to take out with us will be in your own name (i.e. not for a partnership or a limited company).

What do you accept as proof to get a mirrored NCD?

Acceptable proof for mirror no claims discount is a document from your other car or van insurance policy on their headed paper which includes the following information:

- The other policy is in the same name as the one you are taking out with us

- The other policy is still in force

- The other policy is issued by another UK insurer

- The number of years no claims discount you are currently entitled to on your other policy.

Manage your policy online in your AXA account

It’s quick, easy and secure to make changes to your policy in your online account. And if you need to speak to one of the team, we’re on hand to help.

It’s important that you keep all your details as up to date as possible and take reasonable care to give accurate information at every stage. You should also make sure all questions have been answered accurately when buying, renewing or making any changes to your policy. This applies to both the policyholder and anyone acting on their behalf.

False or inaccurate information could mean your insurance is no longer valid – and might affect any future claims and the amount you receive. It’s a criminal offence under the Road Traffic Act 1988 to make a false statement for the purposes of obtaining a motor insurance certificate.

What change would you like to make to your van insurance?

Change vehicle registration

Follow this step-by-step guide to update your vehicle registration.

- Log into your AXA Account.

- If you have more than one van policy, choose the policy you need to update from the tabs.

- Under the ‘policy details’ tab, click ‘change policy details’.

- Add the date you’d like the change to come into effect and update your vehicle registration in the appropriate section.

- Please also review and update any other vehicle information that may have changed, such as mileage, vehicle security or signwriting.

- Complete the change.

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Change your address

Follow this step-by-step guide to update your address:

- Log in to your AXA account

- If you have more than one van policy, choose the policy you need to update from the tabs

- Under the ‘policy details’ tab, click ‘change policy details’

- Add the date you’d like the change to come into effect

- If your van’s overnight location is also changing, please update this in the ‘overnight location’ section

- You will then be able to update your address in the ‘drivers details’ section

- Complete the change

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Update your contact details

Follow this step-by-step guide to update your contact details:

- Log in to your online AXA account

- Click the ‘my details’ tab at the top of the page

- You’ll then be able to see the current contact details we have for you – click ‘edit account details’ to change them

- Once you’ve updated your contact information click ‘save changes’

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Add or remove a driver

Follow this step-by-step guide to add or remove a driver from your policy

- Log in to your AXA account

- If you have more than one van policy, chose the policy you need to update from the tabs

- Under the ‘policy details’ tab, click ‘change policy details’

- In the driver’s detail section, add a new driver or remove an existing one

- Complete the change

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Temporary vehicle insurance

If need temporary cover for another vehicle, please contact our team.

0330 159 1509Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Travelling to the EU

Travelling to the EU is simple withAXA van insurance. Here are a few key details that you may find helpful to know before you travel.

- Your AXA van insurance policy automatically includes basic cover for travel in the EU

- However, we can increase this to your normal level of policy cover for up to 93 days, in any one period of insurance*.

- Before you travel you need to let us know some details about your trip

- How many days you’ll be abroad

- Where you are going

- Who will be driving the van

- We’ll then provide you with a Green Card free of charge, as proof of cover.

- You’ll need to take a physical copy along with you, as well your certificate of motor insurance.

- You may also need an International Driving Permit – check with the Post Office for details about this.

Green cards for EU travel

Please let us know about your trip 14 days before you leave, so we have time to arrange a Green Card for you.

If you don’t contact us before you travel, we won’t be able to provide you with a Green Card and you’ll also only be insured to the minimum level of cover when travelling in the EU.

Without a Green Card you might also be forced to pay for additional insurance if you’re stopped at a border – and you could encounter problems if you’re stopped by the authorities or you’re involved in an accident during your trip.

*Please be aware that even if you have Breakdown Assistance included in your policy, this only provides cover in the UK. You would have to buy separate EU breakdown cover if this is needed.

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Update policy details and amend cover levels

If you need to make changes to your policy, such as amending your levels of cover, adding employees, or adding an optional extra to your policy, you can do this online.

- Log into your AXA account

- Navigate to the ‘policy details’ section

- Here, you can choose the cover you’d like to change or add to your policy

- You’ll be taken back into the quote journey, where you can make any necessary changes and complete your purchase

Here’s how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

How do I cancel my renewal?

A lapsed or cancelled renewal policy will mean that any benefits you enjoyed as a policy holder will also stop at midnight on the last day of cover.

If you’re looking to cancel your business insurance renewal, you can do this in your AXA account as long as your current renewal date is within the next 30 days. To do this, simply follow these steps:

- Log into your AXA Account

- Click on the renewals message to view the renewal

- Follow the journey through to the quote page

- There you’ll see the option to ‘Decline’ your renewal quote

If your policy is not set to automatically renew, then it will simply end on the renewal date if you don’t contact us.

Here's how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

How do I find out when my policy ends?

Finding out when your policy ends is simple, just following these few straightforward steps.

- Log into your AXA account

- Under the ‘Your policies’ tab, navigate to ‘policy details’

- On this screen, you will see both your policy start and end date

How do I add a permanent driver to my policy?

Adding a driver to your policy is simple, and can be done online right from your AXA account. To find out how, check out the video below for step-by-step instructions.

Here's how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

How do I change the mileage on my van policy?

Changing the mileage on your van insurance policy is simple, and you can do it yourself online from your AXA account. To find out how, check out the video below for instructions.

Here's how you can reach us:

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

How do I reset my password?

Forgetting our password can be annoying but it’s simple enough to reset online. Here’s how you can do it:

- Head over to your AXA account log in page and hit the ‘Forgotten password?’ link

- Enter the email address associated with your AXA account

- If the email you’ve given us matches your account, well send you an email with options to reset your password.

- If you don’t receive an email from us, please double check your email address is correct and doesn’t have any spelling errors

If this hasn’t worked for you, please get in touch and we can help you further.

Here’s how you can reach us:

0330 159 1521

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Need to make a van insurance claim?

What would you like to know more about?

You can register most claims online, so there’s no need to call.

Here’s how you can reach us

If you're making a new claim you can call us:

- Monday to Friday: 9am to 5pm

- Weekends and Bank Holidays: closed

For existing claims, you can call:

- Monday to Friday: 9am to 5pm

Please note: if calling us about an accident outside of our working hours, we're only able to proide emeregency assistance for the recovery of your vehicle if it's undriveable. If this service isn't required, please call us during office hours.

Outside of these hours you will be assisted by Auto Rescue Logistics, our recovery partners who will arrange to recover you and your vehicle.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Windscreen or window damage

Approved repairer service

If you have comprehensive cover then you’ll be able to take advantage of our approved repairer service* and get your window or windscreen fixed in no time. What’s more, we won’t apply an excess to window repairs.

* If you don’t choose to use our approved repairer service then the most we will pay for a claim is £100, after any excess has been deducted.

Arrange a repair or replacement

Lines are open 24/7.

If I make a windscreen claim on my van insurance, will it affect my no claims discount?

No, a windscreen claim won’t affect your no claims discount. However, it may impact your premium when you come to renew your van insurance policy.

Get my policy documents

Where can I find my policy documents and insurance certificate?

Once you’ve bought your policy, you can access all your documents through your AXA account.

Just log in and select the ‘policy documents’ tab in ‘your policies’ – you’ll be able to view or print your policy documents and check your cover.

At AXA, we're no longer sending paper documents unless requested. It's easier than ever to view, download and print your own policy documents online. If you’re happy to do that, you can access your documents from your account following these simple steps:

- Create or log into your AXA account

- On the left-hand side of your screen, select ‘Policy documents’

- Click on the ‘View’ button beside the document your wish to download or print

- The document will open in a new tab where you can view, download or print your document

Please note: Your documents can only be viewed and printed after your renewal date.

Still require a printed copy?

If you would still prefer a printed copy of your documents and are unable to print them at home, you can request these within your account. Just follow these simple steps:

- Create or log into your AXA account

- On the left-hand side of your screen, select ‘Policy documents’

- Scroll to the bottom of the page where you will see a link to request your documents

- Click the link and choose which document you would like is send to you

- Choose ‘confirm posted documents’ and let us handle the rest

Get a quote

The quickest way to get a quote is online.

Why can’t I find my van when I enter my registration number?

Our systems are updated regularly, but there may be a small number of registrations that we don't recognise. If we don’t automatically find your van details when you enter your registration number, you can always complete a manual search to find it.

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here’s how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Here’s how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Why was I declined?

Unfortunately, we are unable to provide a quote to everyone who asks us for van insurance. Here are some of the common reasons we might decline your quote;

- You have a driver who is aged under 25

- Your van is not used in connection with your business or occupation

- One of your drivers doesn't hold a full or provisional UK driving licence

If you would still like more detail on why you’ve been declined, get in touch and a member of our team can assist you.

Here’s how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Why do I need to tell you about claims?

Having accurate information on any past claims helps us get you the right price. Claims history is one of the important things we look at when deciding on the terms we can offer.

Breakdown assistance

Broken down?

If you’ve added Breakdown Assistance to your policy, please call our emergency breakdown line and we’ll get you sorted as soon as possible.

If your policy doesn’t include Breakdown Assistance, you can still call our UK emergency breakdown referral service – but you’ll need to pay for any costs involved in recovering your van.

Can I add breakdown cover to my policy?

Breakdown Assistance can only be added at the start of your policy, or when you renew it. If you need Breakdown Assistance before your policy is due for renewal, you can buy a standalone breakdown policy with AXA Assistance.

Cancel your van insurance policy

We’re sorry to hear that you’d like to cancel your AXA van insurance policy. If you choose to cancel, you’ll be charged for the days you’ve been covered and a cancellation fee may also apply, as per your policy wording.

If you’re due a refund, we’ll let you know once we process your cancellation.

If you’ve made a claim or a claim has been registered against you, you’ll be charged the full annual premium.

You can cancel your policy online through your AXA account by following these simple steps:

- Log in to your AXA account

- Choose the ‘policy details’ option from the menu

- In the bottom right of this window, choose the red button labelled ‘Cancel Policy’

- You’ll be taken into a 3-step journey to cancel your policy

- First, ensure the details we hold for you are correct and choose the date you want your policy to end

- Then, let us know why you’re cancelling

- Finally, if you’re due a refund you’ll see the amount here and be able to update any contact details for where we’ll send your cancellation notice

- Click ‘Cancel my policy’

If you’ve changed your mind and wish to undo your cancellation, you can do so on this final screen.

If you’d prefer to speak to a member of our team, you can contact us to cancel your policy please contact us using either of the options below.

Please note, you will be unable to cancel your policy online if:

- Your account is in arrears

- You are in the process of making a claim

- You have made a claim in your currently policy year

Here's how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Want to renew your van insurance?

The quickest way to renew your van insurance policy is through your online AXA account. It’s quick, easy and totally secure.

Just log in and select the ‘view my renewal’ from your to-do list – this will take you straight to your renewal page where you can make changes to your policy and view your renewal quote.

How do I cancel my renewal?

A lapsed or cancelled renewal policy will mean that any benefits you enjoyed as a policy holder will also stop at midnight on the last day of cover.

If you’re looking to cancel your business insurance renewal, you can do this in your AXA account as long as your current renewal date is within the next 30 days. To do this, simply follow these steps:

- Log into your AXA Account

- Click on the renewals message to view the renewal

- Follow the journey through to the quote page

- There you’ll see the option to ‘Decline’ your renewal quote

If you’ve changed your mind within your renewal window, you can come back to this page at any point during that time to accept your renewal quote.

However, if your policy is not set to auto-renew, then it will simply lapse on the renewal date if you don’t contact us.

Alternatively, you can call us to speak to a member of our team.

Here's how you can reach us

0330 159 1509

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

When will I receive my renewal invite?

If your policy is due to be renewed soon, you might see an email come through from us with details about your renewal. You can expect an email from us 25 days before your policy is due to renew, and then again 7 days before.

You can find all the details of your renewal online within your AXA account.

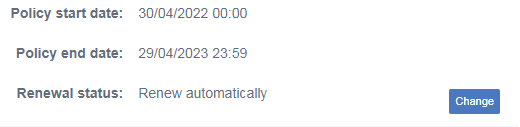

How do I know if I'm on automatic renewal?

Checking whether your policy on automatic or manual renewal is easy. Just follow these simple steps:

- Log into your AXA Account

- Choose ‘Your policies’ from the menu

- Underneath the ‘Policy details’ section you’ll see several details relating to your policy

- The third option down will be labelled ‘Renewal status’

- If you’re policy is on automatic renewal, this will say ‘Renew automatically’, as shown below.

Still haven’t found the answer to your question? Don’t worry.

Here's how you can reach us

0330 159 1509

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

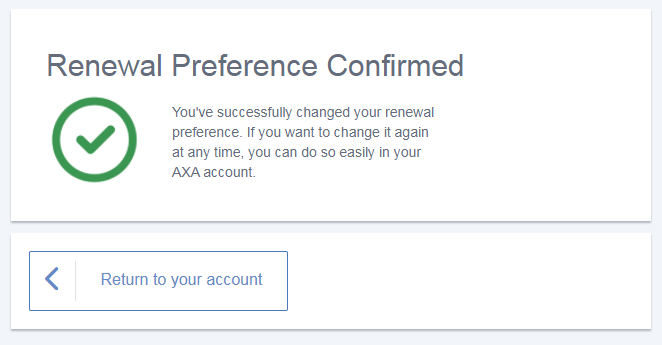

Switching to manual renewal

Switching to manual renewal is easier than ever. Here’s what to do:

- Log into your AXA Account

- Choose ‘Your policies’ from the menu

- Underneath the ‘Policy details’ section you’ll see several details relating to your policy

- The third option down will be labelled ‘Renewal status’

- Beside this option, click the small blue button labelled ‘Change’

- On the next screen you’ll see the terms of your automatic renewal

- At the bottom of this page choose ‘Remove automatic renewal’ then hit ‘Continue with preferences’

- You’ll see the following screen to confirm that your preferences have been changed.

Please note, if your policy remains as a manual renewal your cover will not renew. This means that your business will not be insured unless you have sourced cover elsewhere.

Still haven’t found the answer to your question? Don’t worry.

Here's how to reach us

0330 159 1509

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

How do I switch to automatic renewal?

Switching to automatic renewal is easier than ever. Here’s what to do:

- Log into your AXA Account

- Choose ‘Your policies’ from the menu

- Underneath the ‘Policy details’ section you’ll see several details relating to your policy

- The third option down will be labelled ‘Renewal status’

- Beside this option, click the small blue button labelled ‘Change’

- On the next screen you’ll see the terms of your renewal

- At the boom of the page your will see the following question: ‘Would you like us to automatically renew your policy?’

- At the bottom of this page choose ‘Yes’ then hit ‘Continue with preferences’

- You’ll see the following screen to confirm that your preferences have been changed.

Still haven’t found the answer to your question? Don’t worry.

Here's how you can reach us

0330 159 1509

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Why has my price increased?

If you’ve noticed that your premium has increased when renewing your policy there are a several reasons why your price might be, such as:

- Changes you made to your policy during the past year

- Increases in the cost of claims due to inflation and the cost of part

- You were previously benefitting from a promotional discount which has now ended

Got a question about payments?

If you’ve got a question or need help managing your payments, you can find more information below.

Why am I only able to pay for my insurance policy in full?

We're sorry if we’re unable to offer you a monthly instalment plan.

As a credit lender, we're responsible for making sure our customers can afford the repayments under their credit agreement. We can't offer credit to anyone without checking they’re able to meet the repayment schedule. We also need to do a credit check if a customer wants to change their policy in a way that significantly increases their premium, and when their policy renews.

Checks like this help to make sure that our customers don't end up in financial difficulty, as a result of their credit agreement with AXA.

How can I pay an outstanding balance or direct debit?

If you need to pay an outstanding balance of premium or a direct debit that missed its normal collection date, it’s easier than you think.

- Log intoyour AXA account.

- On your to-do list will be an option to make a payment.

- Select this to pay your outstanding balance.

Still haven’t found the answer to your question? Don’t worry.

Our team can help you chat through your options.

Here's how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

How do I update my payment details?

Need to update the payment details we have for you? No problem. If you’re making a change to your policy that has resulted in a change to your premium, or you’re accepting a renewal with us, then the quickest way to update your details is online through your AXA account.

- Log into your AXA AXA account

- Once you’ve entered the quote journey, complete the steps until you’ve reached the payment page – this will be the last screen

- Here you can change the name(s) of the account holder(s), your sort code, account number and the day of the month you’d prefer we take your payment

- Once you’ve added your new details, hit continue to proceed with your payment

Please note: If there is no change in premium or you're not renewing your policy then you are unable to change your bank details.

If you want to update your bank details but are not making a change or renewinf your policy uyou can still do this by giving us a call using the details below.

Here's how you can reach us

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Why can’t I pay monthly?

Unfortunately, we’re unable to offer monthly payments to everyone as we have a duty to carry out an affordability assessment for new customers and this determines which payment methods can be offered.

Need help with a van insurance question?

You might be able to find the answer using one of our FAQs below.

Do you cover vans with modifications?

We accept some types of vehicle modification, but not all.

To check if we accept a specific van modification, speak to an advisor. Van modifications include getting alloy wheels fitted, making changes to your engine or exhaust system, adding or removing seats, or even installing a new stereo.

Get in touch with full details of the modification, and we'll let you know if we’re able to cover you.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

What is a green card and how do I get one?

What's a green card?

A ‘green card’ is a document that you must carry with you when driving abroad. It proves that you have at least the minimum level of motor insurance required for the country you’re travelling in.

Following recent changes to the system, green cards no longer need to be green – black and white printed documents of the green card are valid in participating EU countries.

If you are looking to be covered to the same level of cover that you have while driving in the UK you will need to contact us before you travel, even if we have previously given you a green card or you don’t need to carry one.

Do I need a green card?

Yes. If you’re travelling to the EU on or after 1st January 2021, you will need to carry a green card with you. If you don’t, you could have to pay additional insurance costs at the borders of any countries you visit.

How do I get a green card? - Step Block

Getting a green card is simple: you just need to request one by getting in touch below.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Why can't I change my van insurance to business use?

Unfortunately, we can’t switch your van policy from personal use to business use. If you need van insurance for business, you’ll need to buy a new policy.

If you need a new van insurance policy for business, you can call us.

0330 159 1521Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

What is the difference between sole trader and personal van insurance?

It’s important that you choose the right van insurance, as it could affect any claims you make or the transfer of a no claims discount.

Personal van insurance covers personal use of your van, like trips away or running errands.

Sole trader van insurance is suitable for those running a business and/or working for themselves. It will cover you for use in connection with the policyholder’s business – for example, when you travel between jobs or carry tools and materials in your van.

Ready to get started?

Do you cover drivers under the age of 25?

No. All drivers must be at least 25 years of age to be insured with AXA van insurance.

How do I contact AXA?

You can get in touch with us on the phone, or via live chat below.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Who do I contact about a broker policy?

Unfortunately, our teams can’t assist with any queries regarding a policy sold through a broker. If you have a problem or query about your policy held with a broker, it’s recommended that you contact the broker directly.

Why has my premium increased?

Your van insurance premium is based on several risk factors, which can cover a number of things such as:

- Where you live

- How many miles you drive each year

- What your van is used for

- If your van has modifications

- If you’ve recently been involved in an accident

If your circumstances change then it’s important that you let is know so that we can update your policy to reflect this, which may result in a change in premium.

Want to find out more about your premium change?

Here’s how you can reach us

You can get in touch with us on the phone or via live chat.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Why can't I find my van registration number?

Our systems are updated regularly, but there may be a small number of registrations that we don't recognise. Enter your registration manually or contact us.

Here’s how you can reach us

You can get in touch with us on the phone or via live chat.

Lines open Monday to Friday, 8am to 6pm. Closed during bank holidays. Chats may be monitored and recorded.

Our team are happy to help with any queries relating to your business, landlord or van insurance policy. Unfortunately, we’re unable to assist with any queries regarding policies sold via a broker, or policies relating to personal products.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

What happens in the case of a total loss?

If your vehicle is determined to be a total loss, the DVLA may need to know that there’s been a change of registered keeper. In these circumstances, we’ll contact you to confirm the process for this, so please don’t change the registered keeper before you hear from us.

Supporting you with the rising cost of living

We know that times are tough out there. From interest rates and energy bills to the everyday cost of food and other essentials, the rising costs are hitting everyone hard.

If you need help navigating these tougher times, please visit our Cost of Living hub and choose your product to see a collection of guides and articles to help support you.

Need to make a van insurance complaint?

Claims complaints

For claims complaints please call us on 0345 605 2914.

Lines are open Monday to Friday 9-5. Excludes bank holidays. Closed Saturday and Sunday.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Policy complaints

For policy complaints please call us on 0330 159 1509.

Lines are open Monday to Friday 9-5. Excludes bank holidays. Closed Saturday and Sunday.

Over the festive period we're here to speak to you:

- : –

- : closed

- : closed

- : –

- : –

- : –

- : closed

- : –

Still need help?

If you couldn’t find the answer to your question above, don’t worry. You can still contact us by using the button below to chat with one of our advisors.

Contacted by a fraudster or fallen victim to a scam?

Report this to us right away and we’ll take it from here and let you know what to do to stay safe.