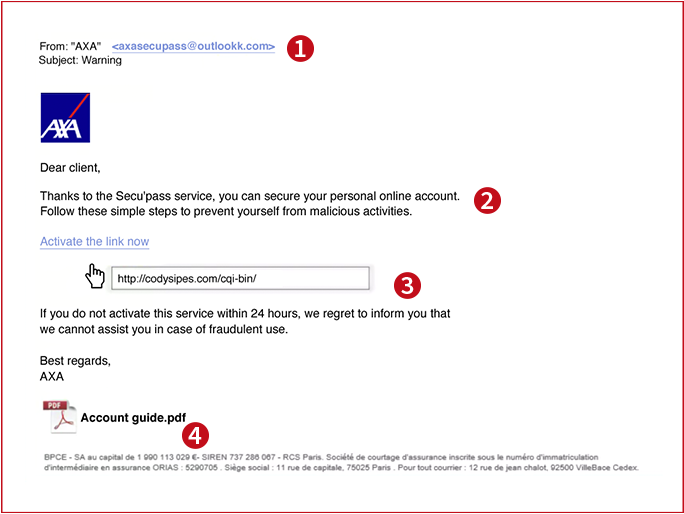

Fraudulent scams

Keeping your accounts and finances safe and secure is as important to us as it is to you. Online scams are ever evolving, and new technologies are making it easier for fraudsters to trick us into revealing our personal information. We want to help you avoid falling victim to fraud by recognising some common types of scams:

If in doubt, always verify the legitimacy of the communication using another communication method such as calling the number listed on the main company website.

Always trust your instincts, if something doesn’t seem quite right it probably isn’t.